The Altman Z-Score is an indicator used to determine a company’s likelihood of declaring bankruptcy. A total of five ratios are necessary for the calculation. Lucky for us, they are all readily available for public companies.

The Formula

Let:

A = Working Capital / Total Assets

B = Retained Earnings / Total Assets

C = Earnings Before Interest / Total Assets

D = Market Value of Equity / Total Liabilities

E = Sales / Total Assets

Then the Altman Z Score can be calculated by:

Z = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

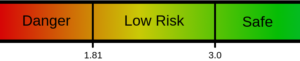

The relative probability of default is determined by the Z value. Specifically,

Z ≥ 3 → Safe

1.81 ≤ Z < 3 → Warning

Z < 1.81 → Danger

Note that these cutoffs are from the original Altman Z Score. Different intervals have been derived for emerging markets. More information is available on Wikipedia.

Algorithm

This algorithm is heavily based on code from Aaron Gilman. It has been updated to work with new versions of QuantConnect.

It works through universe selection. Universe selection allows us to filter equities based on predefined search criteria. In this case, it selects equities that have 1) all the necessary data available for calculating the ratios and 2) a Z Score greater than 1.81. Next, the results are sorted by EBITDA and capital is equally divided among the top 100 equities. The portfolio is re-balanced on the first trading day each month.

Historic Accuracy

In Altman’s initial publication, the Altman Z Score was 72% accurate in predicting bankruptcy within two years. False negatives, however, were extremely low at just 6%. This initial accuracy has not only been proven, but actually found to be a conservative estimate. Over the years, Altman’s model was found to be 80-90% accurate — but with a higher false negative rate of around 15%.

Today, Altman’s Z Score is widely accepted. Originally designed for manufacturing companies with over $1 million in assets, it’s now used in a variety of countries and industries, though sometimes with slight modifications.

Caveats

As with most balance sheet models, the Alman Z Score should not be applied to financial companies. The balance sheets of Wallstreet companies are notoriously opaque and off-balance sheet items are numerous — making accurate calculations nearly impossible.