Robinhood is a brokerage offering commission free trading. This is a big deal. Average online brokers charge between $4 and $12 per trade. These fees can really eat into your profits — especially for new investors with smaller portfolios.

In addition to the usual equity trades, Robinhood also offers services for options and crypto currencies with plans to continue expanding. Limited after hours trading is included, too! The zero-fee structure and multitude of offerings make Robinhood an attractive investment platform indeed.

Is it really free?

Yes, all trades are really commission free. You will pay no fees whatsoever to Robinhood.

Then how does Robinhood make money?

Well, several ways actually. That little bit of cash lying around while you wait for the right stock to buy? Similar to a bank, Robinhood will invest that cash for their own profit. This is the most widely reported tactic.

But… the above method is likely no more than a drop in the bucket for Robinhood. The real money is made through a process called Payment for Order Flow. This is when a brokerage sells transaction information in real time to high frequency trading firms. There is a lot of controversy around the issue as a whole. Interestingly, it was none other than Bernie Madoff that came up with the idea in the first place. Few liked the idea in principal, but none could resist the profitable temptation for long. Today, most brokerages all partake in the practice.

I was speaking with a professor just the other day who declared, “Robinhood is ripping all the millennials off.” After a short discourse, his real problem was not with Robinhood specifically, but with brokerages receiving payment for order flow. TD Ameritrade, Charles Schwab, and Vanguard all participate in this practice, just to name a few. If, like my professor, this is a deal breaker for you Interactive Brokers could be an alternative. In my opinion, order flow agreements should only enter the equation if you regularly buy thousands of shares at a time.

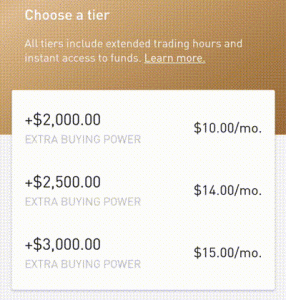

The final way Robinhood generates cash is with paid margin accounts. For a flat monthly fee, investors can receive up to 2x their normal buying power.

Is Robinhood safe?

I’m going to consider “safe” in this context as the likelihood Robinhood is engaging in illegal activity. Obviously, all investments come with an amount of market risk.

I have no special insight, but I do believe Robinhood to be safe. I have had money invested with them since 2016 and have successfully sold, bought, deposited, and withdrawn cash with no surprises. Robinhood is also a member of FINRA, insured under SIPC. What’s that alphabet soup mean for you? Essentially, the Securities Investor Protection Corporation, a non-profit, has your back (up to $500,000). It’s very similar to the FDIC insurance from banks that people are more acquainted with. If Robinhood goes bankrupt for any reason, SIPC will kick in and ensure you receive your shares. There is one important difference, however. SIPC does not protect against illegal activity. If Robinhood knowingly defrauds investors, SIPC insurance is not applicable. While I believe the risk for this is near-zero, it’s a fact worth knowing.

Robinhood’s investors include Kleiner Perkins, Google Ventures, and even Snoop Dogg. So, if the executives take the money and run off to a non-extradition country, at least you’ll be in good company.

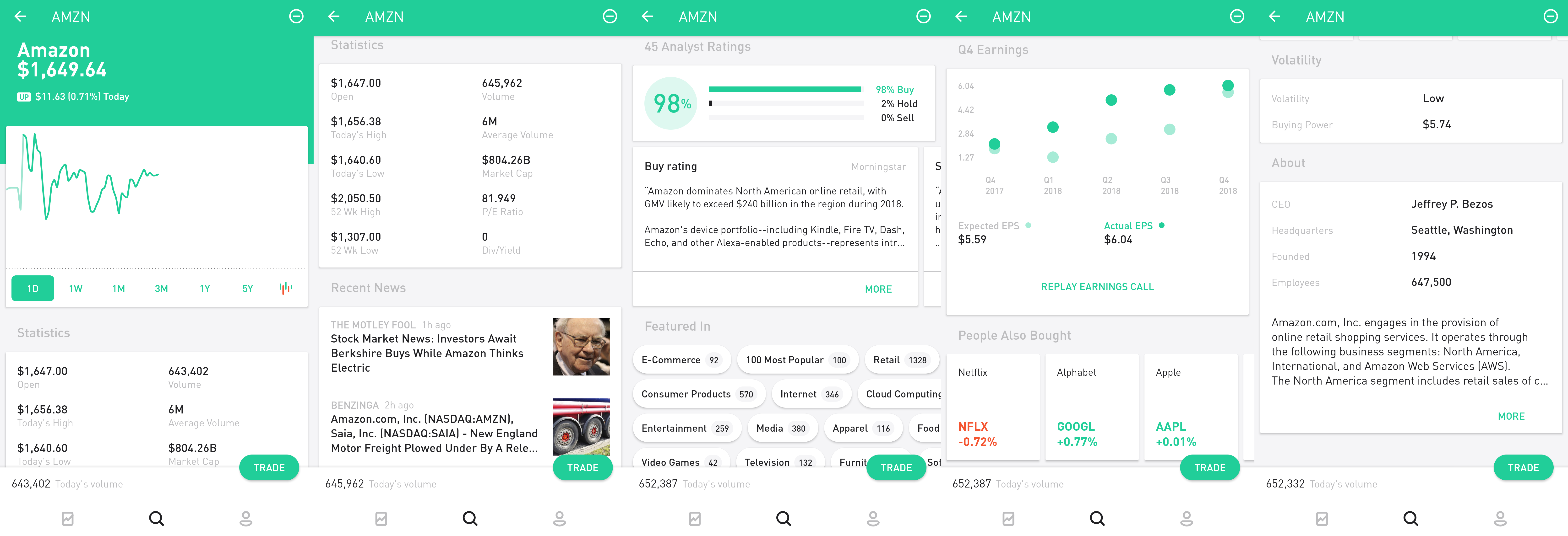

User Experience

Robinhood’s interface, while beautiful, lacks the more thorough information veteran investors are likely accustomed to. This can be easily remedied by researching on another platform and trading with Robinhood.

Don’t expect to be able to fine tune the graph either. Only the presets are available and it’s impossible to overlay multiple stocks, or other indicators to identify fundamentals like death crosses.

Customer support is also lacking. There is no phone number to call, no online chatroom to help. Support is restricted solely to email and can reportedly be a little on the slow side (Reddit link to unhappy customer). I have not had the need to contact them yet, so have no first hand experience to report.

What’s this buzz around cash management?

Recently, RH announced that a Cash Management service will be coming soon. They expect to offer 3% interest on the cash balance in your trading account and let you spend it via a debit card just like a regular checking account.

There is a pretty significant catch, however. Unlike a regular bank, these cash management accounts are not going to be FDIC insured. Originally, Robinhood claimed SIPC protection would apply, but SIPC President Stephen Harbeck quickly refuted their claim.

Until more information is released, it’s impossible to do more than speculate. For now, I’d recommend sticking with a high interest online savings account for collecting risk-free returns and using Robinhood for equities.

Time to take the plunge!

Overall, it’s a great platform for beginning investors or smaller balances that would otherwise be eaten away by trading fees. The compounding nature of investments means the best time to start was yesterday, but the second best time is today.

If you’ve decided to pull the trigger and invest with Robinhood, please consider using this referral link. We’ll both receive a free stock. I would never recommend a product I don’t use myself. I rely on Robinhood for the majority of my stock and options trading.

Still have questions? What’s your favorite brokerage? Let me know in the comments!

Thanks for your reply. One more thing I wish to know is, why Transferwise is only being used for withdrawal and not using it when deposit money from Maybank MY to Maybank SG?